Over 1 Million customers have come to us for advice*

Income Protection

Worried about your finances if you had to take time off work due to illness or injury? Income Protection Insurance can help provide the financial stability you need until you can get back on your feet.

Start my free quoteWhat is Income Protection Insurance?

Income protection is a type of insurance that can pay out if you were signed off work for an extended period due illness or injury. Policies can provide up to 60% of your annual salary and are paid in monthly instalments. Payments can be used to stay on top of your bills until you are well enough to return to work. Typical claims may include:

How does Income Protection Insurance Work?

Income Protection Insurance can help replace some of your salary should you become unable to work due to illness or injury.

Why do you need Income Protection Insurance?

Income Protection Insurance can supplement or replace your sick pay, for a set period or until you retire or the policy finishes, helping to cover the bills while you get back on your feet. This is especially relevant for freelancers or those without sick pay.

What is

a deferred period?

A deferred period is the waiting time between the first day that you are unable to work and when your policy pays out. There are different lengths of time that you can choose from. Usually, the length of the deferred period can affect the price of your premiums.

How long

does it last?

You can choose cover that suits your needs, whether that’s a short-term payout for a max period of 1-5 years, or long-term cover which lasts for as long as you need- until you return to work, retire, or your policy ends.

How much

is paid out?

Income Protection Insurance typically pays out up to 60% off your salary and is paid in monthly instalments.

What does Income Protection Insurance cover?

What’s Usually Covered?

- Income Protection Insurance can cover most illnesses or injuries which stop you from working.

- You can usually claim as many times as you need to while the policy is running.

What’s Not Covered?

- Income Protection Insurance will not pay out if you lose your income due to resignation, redundancy or dismissal.

- There may be exclusions on your policy due to pre-existing conditions.

Don’t just take our word for it.

Hear from some of the dads just like you who chose to protect their families’ financial futures with TOM.

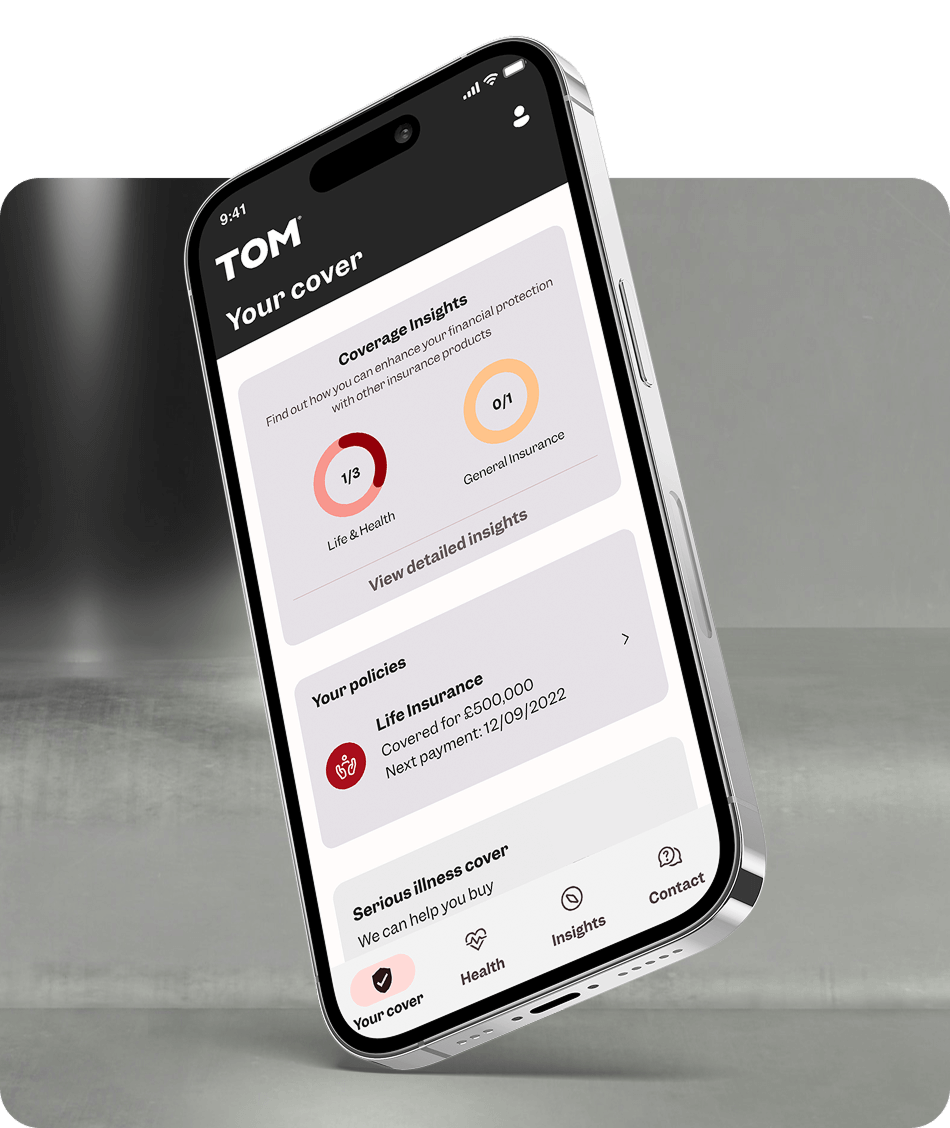

Three steps towards financial peace of mind

- Fill in the form

It’s just a few questions, no confusing financial jargon, and you’ll be done before the kettle’s boiled. Once you’re ready, just hit ‘send’. - Talk to us

Expect a call. Not from a robot, but from a real person who’s here to help you find the right cover for you and your family. - Relax

Let’s be honest, you’re a dad & you’ve got loads on. So we’ll handle the tricky stuff while you get on with your day. Simple, huh?

Income Protection Insurance FAQs

How long does Income Protection Insurance last?

Policies can run anywhere from 2-5 years, or up until you retire, depending on your needs.

How is Income Protection Insurance different from Health Insurance?

Unlike Health Insurance, the monthly pay-out you receive from your Income Protection Insurance can be used to cover any expense, not just medical bills. Each month, you will receive a portion of your pre-tax salary into your bank account, which is designed to help you maintain your lifestyle while you are too sick or injured to work.

What is the difference between Income Protection Insurance and Serious Illness Cover?

While both cover illness and injury, Income Protection (IP) will typically cover most illnesses or injuries which stop you from working, while Serious Illness Cover (SIC) can be more restrictive, and usually requires you to be diagnosed with or suffering from a life-threatening illness. SIC will also pay out one single tax-free lump sum upon diagnosis, while IP will continue to pay out month-on-month for a pre-agreed term or until you are able to return to work.